EBICS is a standard for electronic data interchange between corporates and banks. It was originally specified by the Zentraler Kreditausschuss (ZKA) operated by the central associations of the German banking industry.

The recent adoption of EBICS by the Comité Français d'Organisation et de Normalisation Bancaires (CFONB), the French national institution responsible for standards in banking activities, is a significant move towards joint payment instruments, standards and frameworks supporting the harmonization of national markets. SEPA provides a European-wide payments format. EBICS provides a common communication protocol with strong security features for payment transactions in wholesale banking.

EBICS version 2.4 offers technical solutions for certain French bank requirements, such as the enlargement of identification fields (customer ID, user ID and host ID) to 35 digits, as well as two new order types for uploading and downloading files. EBICS version 2.4 also describes the use of certificates.

EBICS Server and Electronic Signature embedded EBICS client now fully support version 2.5 of the EBICS protocol. For full details of the improvements of EBICS 2.5, refer to the official EBICS protocol specifications.

The most notable features of this protocol version are:

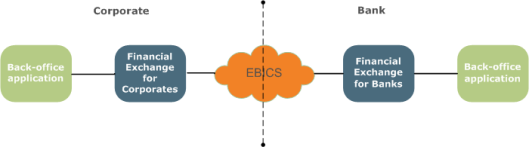

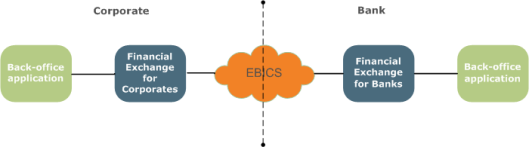

FEX provides a means to implement EBICS exchanges from the corporate side and the bank side of an exchange.

For banking entities, Financial Exchange for Banks (FEX4B) provides a dedicated module to handle the EBICS protocol. Working from a dedicated UI, you can define the partners, security parameters, file types, and so on, that define the exchange agreements with your corporate clients.

You can define multiple instances of your banking entity, and define a virtually unlimited number of remote corporate partners.

For end-to-end monitoring, Financial Exchange for Banks includes the services of Sentinel.

Financial Exchange for Banks can communicate with any fully standardized EBICS corporate client application.

For corporate entities, Financial Exchange for Corporates (FEX4C) provides a dedicated module to handle the EBICS protocol.

Financial Exchange for Corporates enables you to be linked to your back-end applications for dispatching and receiving EBICS exchanges from a corporate environment. For end-to-end monitoring, Financial Exchange for Corporates includes the services of Sentinel.

Financial Exchange for Corporates can communicate with any fully standardized EBICS banking server application.

Overview of Electronic Signature

EBICS Server UI: General operating instructions